San Diego Home Insurance - An Overview

San Diego Home Insurance - An Overview

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Importance of Affordable Home Insurance

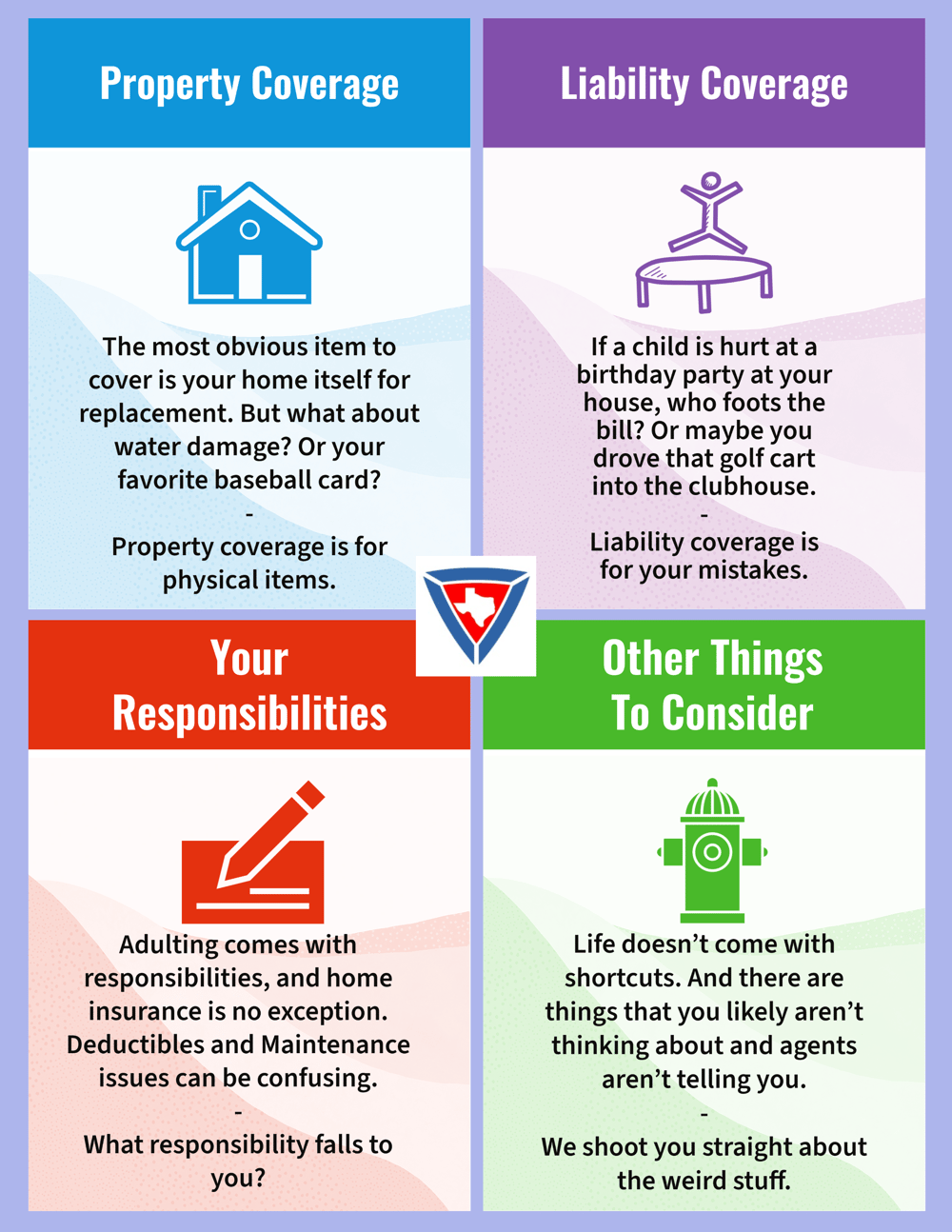

Securing economical home insurance coverage is crucial for safeguarding one's home and monetary well-being. Home insurance gives security against numerous threats such as fire, burglary, all-natural calamities, and personal obligation. By having a thorough insurance coverage strategy in position, house owners can feel confident that their most substantial investment is safeguarded in case of unanticipated situations.

Budget friendly home insurance policy not only gives monetary security however also supplies assurance (San Diego Home Insurance). In the face of increasing home values and building costs, having a cost-efficient insurance plan makes certain that property owners can conveniently rebuild or fix their homes without facing considerable economic problems

Moreover, budget-friendly home insurance can likewise cover individual belongings within the home, using repayment for items harmed or taken. This coverage extends past the physical framework of your house, safeguarding the contents that make a residence a home.

Protection Options and Limits

When it pertains to coverage limitations, it's critical to recognize the optimum amount your plan will pay out for each type of insurance coverage. These restrictions can differ relying on the plan and insurance company, so it's vital to assess them very carefully to guarantee you have adequate security for your home and properties. By recognizing the coverage alternatives and limits of your home insurance coverage, you can make enlightened choices to safeguard your home and enjoyed ones successfully.

Variables Influencing Insurance Policy Expenses

A number of variables substantially influence the costs of home insurance plan. The area of your home plays a crucial duty in establishing the insurance policy costs. Houses in areas susceptible to natural calamities or with high crime rates great post to read typically have higher insurance coverage expenses due to raised dangers. The age and condition of your home are additionally aspects that insurance firms think about. Older homes or properties in inadequate problem might be a lot more costly to insure as they are extra at risk to damages.

Furthermore, the sort of protection you choose straight impacts the expense of your insurance plan. Choosing added protection alternatives such as flooding insurance or quake protection will certainly increase your costs. Choosing higher insurance coverage limitations will result in higher costs. Your insurance deductible amount can additionally impact your insurance policy costs. A greater deductible typically means reduced costs, yet you will certainly have to pay even more expense in case of a case.

Furthermore, your credit history score, asserts background, and the insurance policy firm you pick can all affect the rate of your home insurance coverage plan. By taking into consideration these variables, you can make informed decisions to help manage your insurance costs effectively.

Comparing Quotes and Companies

:max_bytes(150000):strip_icc()/modular-vs-manufactured-home-insurance-5074202_final-3c70b04af30a43c6ba0ba87089373bf7.png)

In enhancement to comparing quotes, it is crucial to assess the online reputation and monetary security of the insurance coverage providers. Seek client testimonials, scores from independent firms, and any background of complaints or governing activities. A trusted insurance copyright need to have a good record of without delay refining cases and giving superb customer support.

Furthermore, consider the details insurance coverage functions used by each service provider. Some insurance companies might supply fringe benefits such as identification theft protection, tools break down coverage, or insurance coverage for high-value products. By very carefully comparing service providers and quotes, you can make an informed choice and select the home insurance policy plan that finest meets your demands.

Tips for Saving on Home Insurance

After extensively comparing quotes and providers to find one of useful link the most suitable protection for your needs and budget plan, it is prudent to check out effective approaches for minimizing home insurance coverage. Among the most considerable means to save money on home insurance policy is by bundling your plans. Several insurance coverage firms offer price cuts if you acquire multiple policies from them, such as incorporating your home and auto insurance. Boosting your home's security steps can additionally lead to cost savings. Mounting security systems, smoke detectors, deadbolts, or an automatic sprinkler can lower the check these guys out threat of damage or theft, potentially reducing your insurance policy costs. In addition, keeping a good credit history can positively impact your home insurance rates. Insurance companies usually consider credit rating when establishing costs, so paying expenses on schedule and managing your debt properly can cause lower insurance policy prices. Lastly, regularly examining and updating your plan to reflect any type of adjustments in your home or conditions can guarantee you are not spending for insurance coverage you no more demand, aiding you save money on your home insurance coverage costs.

Conclusion

In final thought, guarding your home and loved ones with affordable home insurance is essential. Executing suggestions for saving on home insurance coverage can likewise assist you protect the necessary security for your home without damaging the bank.

By unwinding the details of home insurance coverage strategies and discovering practical strategies for protecting economical insurance coverage, you can ensure that your home and enjoyed ones are well-protected.

Home insurance policy plans commonly supply a number of coverage alternatives to secure your home and personal belongings - San Diego Home Insurance. By comprehending the coverage alternatives and limits of your home insurance coverage policy, you can make informed choices to protect your home and enjoyed ones successfully

Frequently evaluating and upgrading your policy to mirror any type of adjustments in your home or scenarios can ensure you are not paying for protection you no longer need, aiding you save money on your home insurance coverage costs.

In final thought, safeguarding your home and liked ones with affordable home insurance policy is essential.

Report this page